References

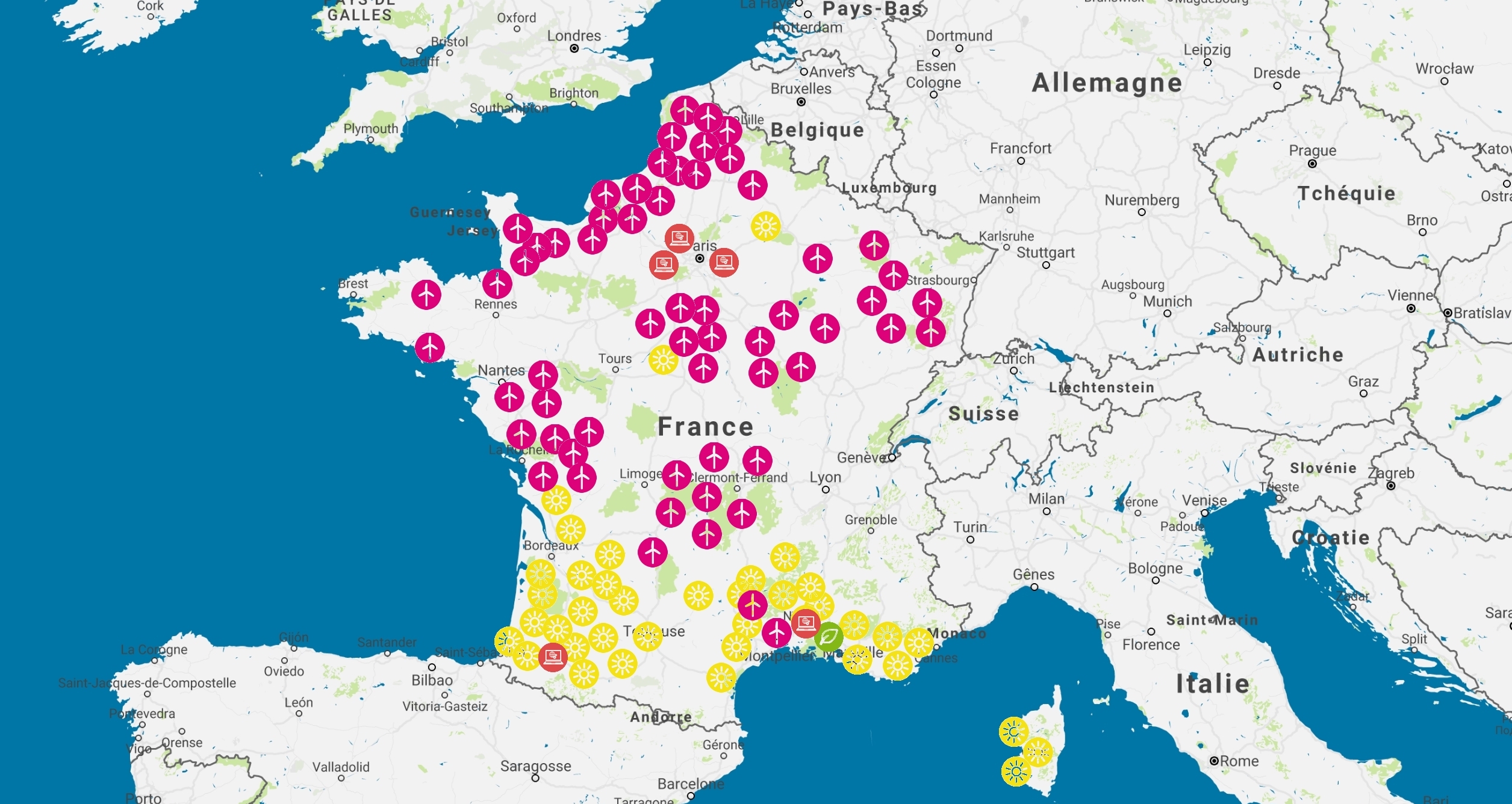

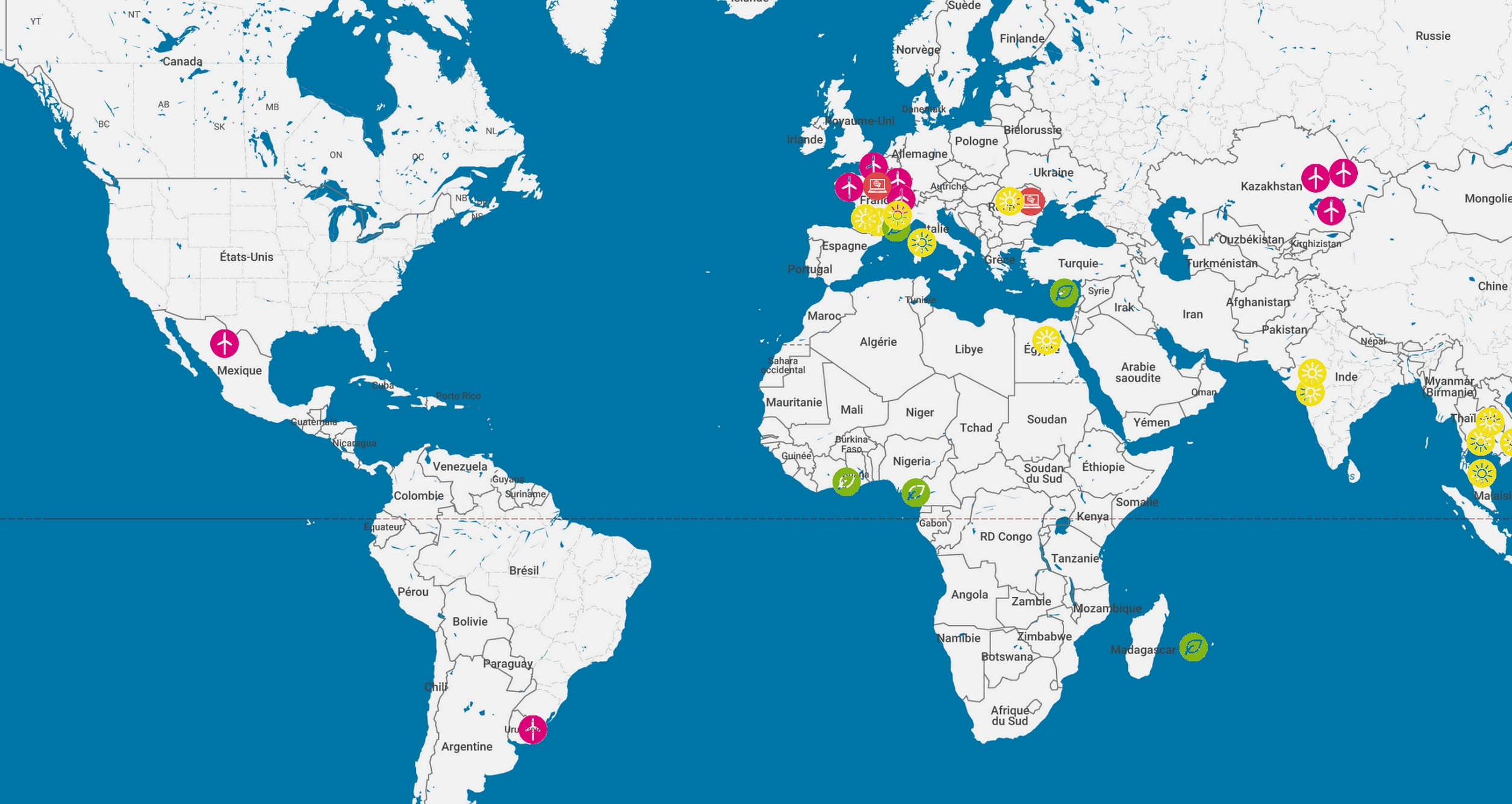

Untill today, Green Cape Partners has finalized more than 2 GW of transactions in wind and solar pipelines and projects. More than 330 projects have been financed or refinanced. Green Cape Partners has been active in 19 countries.

I. TRANSACTIONS INFRASTRUCTURES RENEWABLE ENERGIES

SELL SIDE Wind 2020

Sell Side advisor, Sale Aalto Power to Iberdrola (120 MW of wind projects in operation, 650 MW of wind projects in development), signed

BUY SIDE Solar – Biomass 2020

Buy Side advisor on the account of Idia Capital, various solar operations (corporate valuation, capital increase). Apex (with BPI), Amarenco…

SELL SIDE Wind 2019

Valuation and advising on 4 wind projects located in France, Inersys

SELL SIDE Solar 2019

Sell Side Advisor for 10 rooftops projects in France (21 MW)

SELL SIDE Solar 2018-2020

Sell Side Advisor for a 90 MW portfolio in France on the account of a major utility, closed

BUY SIDE Wind 2018

Buy Side advisor on the account of Canadian IPP, acquisitions of 3 wind projects in France, closed

BUY SIDE Solar 2018

Buy Side advisor on the account of an institutional solar investor in France,

51 MW

BUY SIDE Solar 2018

Buy Side advisor on the account of an infra investment fund, 285 MW

SELL SIDE Wind 2017

Sale of two wind projects in France ready to build and in operation from WKN AG to Quaero Capital, 21 MW, seller advisor

BUY SIDE Wind 2017

Buyer Due Diligence and Financial Modelling for the acquisition of 3 wind projects in operation in France, 60 MW

BUY SIDE Wind 2017

Market Study and buy side mandate by a foreign IPP, wind projects “early stage” in France

BUY SIDE Wind 2017

Market Study and buy side mandate by a foreign turbine manufacturer, wind projects “late stage” in France

BUY SIDE Solar 2017

Market Study and buy side mandate by a foreign investment fund, solar projects in France

SELL SIDE Wind/Solar 2016

Sale of the group Eole Avenir Developpement to the Langa group (90 MW wind and 35 MW solar), seller advisor

SELL SIDE Wind 2015

Sale of a wind pipeline of 400 MW in France from Engie (Maïa Eolis) to Voltalia, seller advisor

SELL SIDE Solar 2015

Advisory mission on a 32 MW solar PV project in Egypt, minority participation, seller advisor

SELL SIDE Solar 2015

Advisory mission on a 60 MW portfolio, South-East Asia (Thailand, Philippines, Singapore…), partly closed

SELL SIDE Solar 2015

Sale of a 20 MW portfolio before CRE 3 tender offer

II. DUE DILIGENCES

BUY SIDE Solar 2020

Buy Side advisor on the account of Idia Capital, on the fundraising of Amarenco, 15 m€.

BUY SIDE Solar – Biomass 2018-2020

Buy Side advisor on the account of Idia Capital, various solar operations (corporate valuation, capital increase). Advisor on the operation Apex, 15 m€ with Idia Capital and BPI.

BUY SIDE Wind 2019

Advisory Mission on market electricity prices on the account of I4B (Belgian Infra Fund)

BUY SIDE Solar 2017

Buy Side advisor and Due diligence on the account of EKZ in an operation of acquisition of 3 wind farms, France.

III. FINANCING INFRASTRUCTURES RENEWABLE ENERGIES

FINANCING Solar 2020

Refinancing of one ground mounted plant, Amarenco, 25 m€, closed

FINANCING Wind 2020

Renegotiation of an existing loan, 10 wind projects in France, € 90 million, Aalto Power

FINANCING Solar 2019

Financing of 10 rooftops projects in France (25 MW)

FINANCING Solar 2019

Financing of one ground mounted plant, 80 MW, Dhamma Energy, financial modelization on the account of CEPAC and Dhamma Energy

REFINANCING Solar 2018

Re-leveraging (non-recourse debt) of solar plants, Corsica € 10 million, operation in progress

EQUITY BRIDGE Solar 2018

Bridge Financing, solar PV (rooftops), € 5 million, operation in progress

FINANCING Solar 2017

Financing of a new portfolio of solar assets, € 35 million, Amarenco with the Bank of Tokyo-Mitsubishi

REFINANCING Solar 2017

Re-leveraging of an operating portfolio of solar assets in France, € 45 million, operation in progress

BOND FINANCING Solar 2017

Bond Financing for solar projects in France, Dhamma Energy, € 5 million

BOND FINANCING Wind/Solar 2017

Market Study concerning the condition of mezzanine debt in France

REFINANCING Solar 2016

Re-leveraging (non-recourse debt and mezzanine bonds) of solar plants, Corsica, Dhamma Energy, € 20 million

REFINANCING Solar 2016

Re-leveraging of solar plants in France, rooftops with Fonroche and CEPAC, € 40 million

FINANCING Biomass 2013

Financial Structuring on a tender offer, PFI, Dalkia, 10 MW

IV. MARKET STUDIES AND OFF MARKET DEALS

MARKET STUDY Solar-Wind 2020

Screening of the French market, on the account of an infrastructure fund, solar and wind, projects in development.

MARKET STUDY Wind 2020

Screening of the French market, on the account of an infrastructure fund, wind project in operation.

MARKET STUDY Biomass 2020

Screening of the French market, main actors of biomass and biogas in France (players, investors, banks). Thourough analysis of the French market.

MARKET STUDY Solar 2020

Market Study of the main drivers of value creation on the French wind market.

MARKET STUDY Solar/Wind 2017

Market Study concerning the condition of mezzanine debt in France

MARKET STUDY Wind 2017

Market Study and buy side mandate by a foreign IPP, wind projects “early stage” in France

MARKET STUDY Wind 2017

Market Study and buy side mandate by a foreign turbine manufacturer, wind projects “late stage” in France

MARKET STUDY Solar 2017

Market Study and buy side mandate by a foreign investment fund, solar projects in France

MARKET STUDY Others 2017

Market Study on Investment Opportunities in Moldova (Energy, Waste, Biomass, Agribusiness…)

MARKET STUDY Wind 2016

Market Study for a major foreign IPP on French market wind actors

MARKET STUDY Wind 2015

Market Study on Wind Regulation Kazakhstan

MARKET STUDY Energy 2015

Study on Electricity Regulation, in Ivory Coast

MARKET STUDY Energy 2015

Study on Electricity Regulation, in Mauritian Island

MARKET STUDY Energy 2015

Study, Energy environment, Crete

V. FINANCIAL MODELING

MODELING Biomass, Wind, Solar 2019

Development of a complete corporate and M&A model for the account of Idia Capital Partners

MODELING Wind 2019

Modeling of the complete Transaction, Sale of a French IPP with 120 MW of projects in Operation and 650 MW of projects in Development, Aalto Power

FINANCING Solar 2019

Financial Modeling for Dhamma Energy, solar project, 80 MW, audited model on the account of CEPAC

MODELING Solar 2019

Financial Modeling on the account of Opale EN, for ground mounted and rooftop solar projects

MODELING Wind 2019

Financial Modeling for Inersys, 4 ready-to-build wind farms

MODELING Solar 2019

Financial Modeling on the account Amarenco, 21 MW Transaction

MODELING Wind 2017

Financial Modeling for an Wind Developer, Transaction

MODELING Wind 2017

Financial Modeling for a Wind Investor, Due Diligence

MODELING Solar 2017

Financial Modeling for an Solar Investor, Transaction

MODELING Wind/Solar 2016

Financial Modeling for an Investment Fund, 5 models, Mezzanine projects, wind and solar complex models

MODELING Wind 2016

Financial Modeling for an Wind Developer, Internal Reference Model

MODELING Solar 2016

Financial Modeling for an Solar Developer, Financing Model

VI. M&A AND FUNDRAISING

M&A 2020

Sale of Aalto Power (120 MW in operation, 650 MW in development) to Iberdrola

Venture Capital 2020

Investor advisor on the account of Idia Capital, operation Amarenco, 15 m€.

Venture Capital 2020

Investor advisor on the account of Idia Capital and BPI, operation Apex, 15 m€.

Venture Capital 2018-2020

Investor advisor various operations, solar, wind, biomass.

M&A 2016

Sale of the group Eole Avenir Developpement to the Langa group (90 MW wind and 35 MW solar)

Venture Capital 2015

Fundraising, energy eciency company, € 2.3 m, ECO GTB with Aster Capital and Alter Equity

Venture Capital 2015

Fundraising, energy efficiency company, Aqylon, ORC, Heat pumps, € 1.2 m, private placement

Venture Capital 2014

Fundraising, monitoring of energy plants, BlueNRGY power management company, $ 5 m, done

Venture Capital 2014

Fundraising for Energy Power Lab, 600 k€, private placement

Venture Capital 2014

Financing of an ORC project on a Veolia site with Smart Energies, € 1 million

AMONG OUR CLIENTS